- News & Activities

- Posted

Empowering the Syrian Pound … by Ending Liberal Policies

Three Aspects: Food, Manufacturing, and Driving out the Dollar

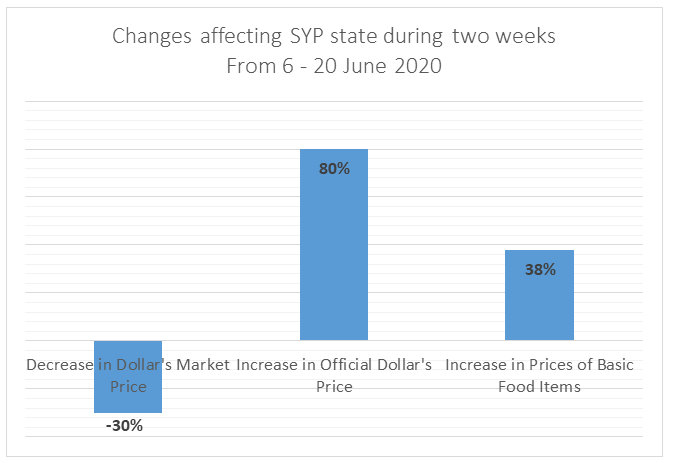

The “security operation to confront speculation”, of which we only saw pictures of accumulated dollars on Facebook, has ended. Following these measures, even though the market price of the Syrian pound (SYP) to the dollar decreased by 30% and the Central Bank price rose by nearly 80%, these two prices have not yet reached one another. More importantly, overall prices, including food, continued to rise, to reach within two weeks an increase by more than 38%. All of this took place before the Caesar Act had even entered into force.

Ashtar Mahmood

The deterioration of the Syria pound is an important political juncture, not only in the course of the Syrian humanitarian catastrophe but also for the political fate of the country. It not only makes imminent a “cardiac arrest” for what remains of the Syrian economy, but is also rather a path to starvation leading to chaos, as well as an essential tool for partition.

The question that should be posed is: What keeps the Syrian pound fragile in the light of the changes in the dollar? How can the stability of domestic prices be increased with effective economic and political tools, and not by the “fire-extinguishing” logic that deals with the results and does not search for the actual cause of the fire?

Security measures cannot solve the SYP problem that is inherent in liberal policies favoring the rich and speculators

The Syrian Pound Loses its Power and Depends on the Dollar

What does the collapse of the SYP mean economically? A currency loses value just like any other commodity, when there is more supply and less demand. There is a large accumulation of the Syrian pound in the Syrian market, while the demand therefor is low.

As for why the demand is low, the reasons are many and complex, but at the heart of it, we can say that the Syrian pound lost the ability to effectively perform the basic functions of a currency: pricing, investing, and trading. Currently, the decisive reason for this is that the major economic and financial powers that own most of the resources carry out their investment operations in dollars, and their main activity is import, smuggling, and speculation, and the Syrian pound for them is nothing more than an interim intermediary they seek to immediately get rid of and exchange it to dollars. The estimate of the amount of profit converted from Syrian pounds to dollars is at about one billion Syrian pounds per day, which is approximately 5% of the daily domestic product, but is capable of influencing the trajectory of the currency, as this amount and its power increase with the economic stagnation.

The deterioration of the Syrian pound is the result of its buoyancy and susceptibility to floating and fluctuating with the waves of demand and supply of stronger currencies such as the dollar, naturally. The collapse of the Syrian pound can be prevented by giving it power and weight, generally by expanding the production of goods and services locally, so that the existing amount of Syrian pound is proportionally commensurate with a mass of goods and domestic economic activity.

If this is generally the necessary direction that is inevitable, it is possible to define faster and more decisive mechanisms and procedures that raise the value of the Syrian pound, stabilize it, and drive it upward.

Increasing the Syrian Pound Weight by Tying it to Basic Commodities

Giving the Syrian pound weight and preventing it from floating, would be by linking to the Syrian pound a set of basic commodities that affect the level of prices and the standard of living, not only by imposing an official exchange rate by the state but more importantly, linking the entire process of producing, circulating, and consuming these commodities to the local currency, or at least isolating them from the dollar, without this there is no point in the official exchange rate.

In other words, the components of the basic consumption unit (food and medicine at least) and the strategic commodities that determine the price levels of prices (such as energy, transportation, and basic manufacturing and agricultural needs) should all be isolated from the dollar or at least from the fluctuations of demand and supply thereof. On the other hand, all these things should be produced, traded, and consumed in Syrian pounds and through domestic arrangements that are not externally linked or isolated from the impact thereof.

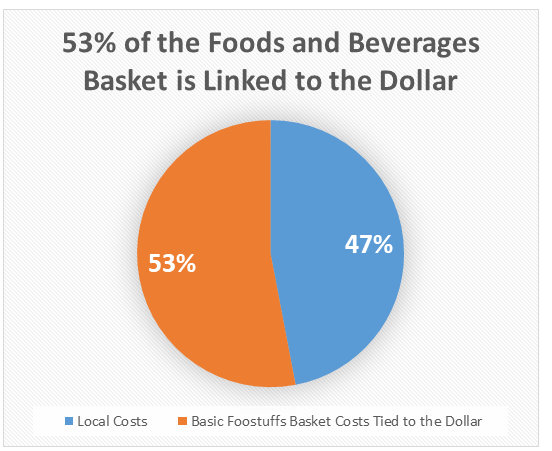

In the current Syrian situation, the basic foods basket is linked to imports by more than 50%, and medicines and their manufacture have also entered a crisis because of being linked with the dollar and the inability of pricing them locally to keep up with the cost. Likewise, basic products such as fertilizers, iron and aluminum, cotton threads and yarn, plastic and others are all linked to the dollar. Energy products are also imported and priced at prices that exceed international prices. All of this is in addition to the smuggling movement out of the country that puts the prices of local products at regional prices and their prices for the Syrian consumer are calculated based on the smuggling price, which is in dollars, the price of lamb meat being one example.

So, how can these products be linked to and priced in Syrian pounds, and their price fixed according to stable local cost limits?

330K Syrian pounds is the cost of the food basket, and 53% of these costs are imported foodstuffs or imported needs for production thereof, such as sugar, rice, oils, beverages, poultry feed, etc.]

Three Aspects for Serious Policies

The process requires serious policies in basic directions that can be divided into three points:

Firstly, food: Focusing on and starting from domestic food production systems for imported basic foodstuffs, specifically flour, sugar, oils, poultry feed, and baby formula, and even rice, which can be cultivated domestically. This could be done by allocating funds to invest in supporting basic crops, food manufacturing, and subsidized distribution. The goal would be to disconnect food from the dollar (a Kassioun piece on the subject, Arabic) and reduce the prices of the basic foods unit, the costs of which have become more than 6 times the minimum wage.

Secondly, manufacturing industries: Supporting a set of basic manufacturing industries that would reduce imports, which government agencies (statement by the Ministry of Economy & Trade, Arabic) estimated could cover more than 70% of imports through more than 80 items that could be manufactured domestically. However, this needs an investment mass; this may not require more than government facilitation and the lending amount, as private manufacturing industries showed high flexibility in 2017-2018 when the real values of its production rose to a level higher than that of 2010, and grew by more than 30% (a Kassioun piece on the subject, Arabic) in 2017 merely as a result of the relative security stability and stable exchange rate.

One cannot expect and stop at the initiatives of private investors in this field, because those will not proceed to expanding productive investment unless they ensure there is the necessary threshold of exchange rate stability and inflation levels – the most important thing in facing the greatest challenge of productive operations, which is the influence of speculative and smuggling forces that prevent market stability and link it to the dollar.

This is aside from the number of general industries that have been suspended pre-crisis and during it, an important part of which has regressed to the point of stopping over the last few years, the operations of which can be gradually revived with some investment. Illustratively, there are more than 24 categories of industry that have been suspended before the crisis as a result of imported alternatives and corruption, which put an end to the effectiveness of general manufacturing such as: internal and external tires, pallets and iron bars and metal pipes, electric motors and transformers (suspended since 2008-2009), dry and liquid batteries, stoves and ovens, aluminum clips, tractors, water and power meters, glass and ceramic products, internet, ceramics, wall tiles, etc. In the remaining general industries, the regression rates ranged from 44% to 99% in industries such as: flour and bread, vegetable oil, cotton-based animal feed, pasteurized milk, tobacco, sugar products, yarn and fabrics, leather and fertilizers, televisions, cables and wires, and cement. The infrastructure and expertise of all these industries are still available and some still in operation; however, they only need to expand to general investment spending from the Syrian pound allocations, which are not being employed, while remaining deposited in banks and reserves. (See: Kassioun, Issue 954, Arabic).

Thirdly, alternative monetary and trade policies: There is an amount of basic imports that are essential, such as fuel (currently) and the needs for the pharmaceutical industry and others, the types and quantities of which can be precisely determined. Securing this amount must be done through official channels, without the dollar, and outside the Western banking system. All this is possible through relations with parties able to bypass sanctions: by establishing joint banks and bartering mechanisms and using local currencies, and setting up accounts in Chinese yuan and trading with China through it; these mechanisms have been discussed previously in detail and cannot be sufficiently and fully covered here. (See: Kassioun, Issue 969, Arabic)

The basic principle: the Syrian pound should be used to ensure independence and domestic production of food; local manufacturing industry should be expanded to reduce the burden of the dollar and increase the domestic industrial income; and options of monetary and trade policies should be sought in order to import a portion of the basics without increasing the demand for the dollar.

Liberalism of those with Influence Swallowed up the State Apparatus

Measures, such as those noted above, are a turning point in general economic policy, and it requires a state apparatus that has the ability to take decisions, and therefore has the resources and the ability to implement, which is what the country (Syria) lacks. Governments that cannot effectively govern in Syria are a product of a political structure, where the weight of corruption and speculation forces is overwhelming in the critical spheres of influence.

These forces that adopted economic liberalism since the turn of the millennium were not only an important factor in the interaction of internal contradictions and the eruption of the crisis, but also managed the deepening economic crisis during the past years, which allowed warlords and “top” speculators to become more ferocious, which the remaining production and producers regress.

Examples are plentiful: In practice, an important part of the reserve was spent to supply the speculative market with dollars during the first five years of the crisis, and that is part of the liberal monetary policy that seeks to stabilize the exchange rate and not the purchasing power of the local currency. What was left of the food production systems were dismantled, where the cultivation of beets and cotton ended, and the wheat cultivation regressed without any serious attempts to recover them. There is even a clear effort to dismantle the bread production system, which is the only one left.

The logic of import licenses and the financing of imports with the dollar was adopted through the central bank as a mechanism to stabilize the prices of imported materials, but this policy narrowed and restricted the import circle to an influential few, and provided them with the ability to obtain dollars officially at a lower price than the market price and useful for speculation, and a blind eye was turned on them pricing their imports based on the market dollar price. This mechanism was later suspended, and they were left to price things without controls, the latest of which was announced last week to stop financing imports even basic foodstuffs.

Not to mention giving up state revenues in the telecommunications sector, and using it to own land for rentier real estate projects in partnership with large investors after forcibly evicting citizens from their homes and compensating them with small amounts over a long period of time, while leaving them to rent in these circumstances. Other things that are worth mentioning include things like licensing luxury consumer and industrial projects that almost entirely depend on imports like collecting cars. To add to all this, and the worst of it all, was letting warlords be active in speculation, black market trade, smuggling, royalties, etc.

While, on the other hand, there were no serious steps taken from those declared in the thousands of statements that talk about supporting production, even at the level of settling and exempting industrial loans, or at the level of re-lending to farmers, while thousands of billions of Syrian pounds are accumulated in public and private banks.

These policies are a continuation of previous ones since the adoption of economic liberalism, and the years of war have not changed anything. To the contrary, the adopted economic policies were and still are a real aggression and challenge in the face of the country’s continuance, in that they have contributed effectively to impoverish millions, reduce the feasibility of production and the emigration of producers and experiences, and contribute to the collapse and fragility of the Syrian pound. At the same time, they reinforced the control of warlords who besiege Syrians through their livelihood with violence that is no less than that of the external siege. Thus, these policies and their sponsors threaten the country’s continuance and ability to succeed in passing through the “bottleneck” that the sanctions constitute.

Ashtar Mahmood

Ashtar Mahmood