- Articles

- Posted

De-Dollarization of the Global Economy: No Longer a Far-Fetched Issue

The global financial system reflects the way in which international economic exchanges, pricing mechanisms, exchanging between currencies, and the settlement of financial payments are arranged. As is the case in all historic phenomena, the international financial system is not eternal, rather a phenomenon that evolves according to the changes in circumstances and balances.

At the end of World War II, the United States of America have pushed towards the creation of the Bretton Woods system, which entrenched the US Dollar as a global exchange currency. Since the beginning of the 1970s – with the beginning of the neoliberal phase – reaching the outbreak of the global financial crisis in 2008, the world witnessed a U.S. coup against the Bretton Woods system. That was when the United States announced the elimination of backing the dollar with gold. Nevertheless, the dollar has maintained its position as a global exchange currency relying not on gold backing, but rather on the U.S. hegemony and power that has dominated the planet as a single pole and “global policeman”.

The Changing of Economic Weights and International Contribution

After the outbreak of the global financial crisis in 2008, the changes in international balance of power and global developments in general have put the dollar’s hegemony in front of radical challenges. Since then, particularly, initial processes of the de-dollarization of the global economy have started to accelerate strongly, and the indicators of this are:

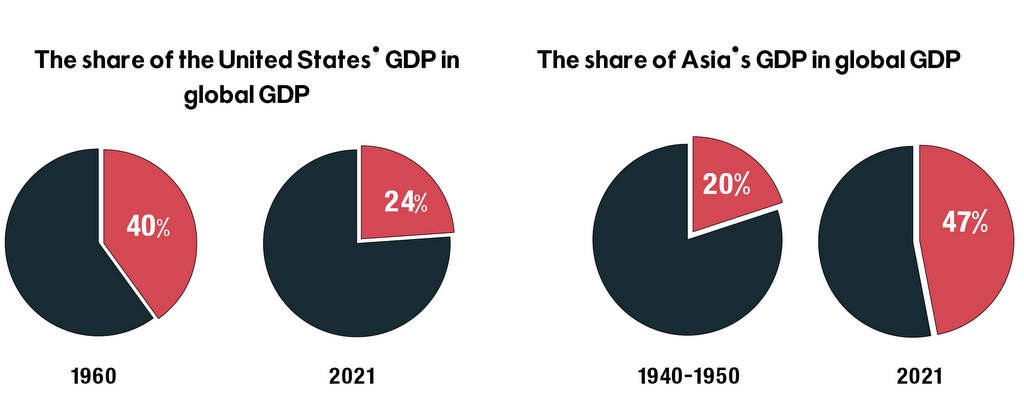

First: the collaboration of the multipolar global economy has evolved profoundly, which is primarily based on the rapid increase in the GDPs of non-US countries, and the contribution of these countries in the global GDP. While the share of the United States’ GDP in the global GDP has decreased from 40% in 1960 to 24% in 2021, the GDP of Asia in the Global GDP has increased from 20% forty or fifty years ago to 47% in 2021.

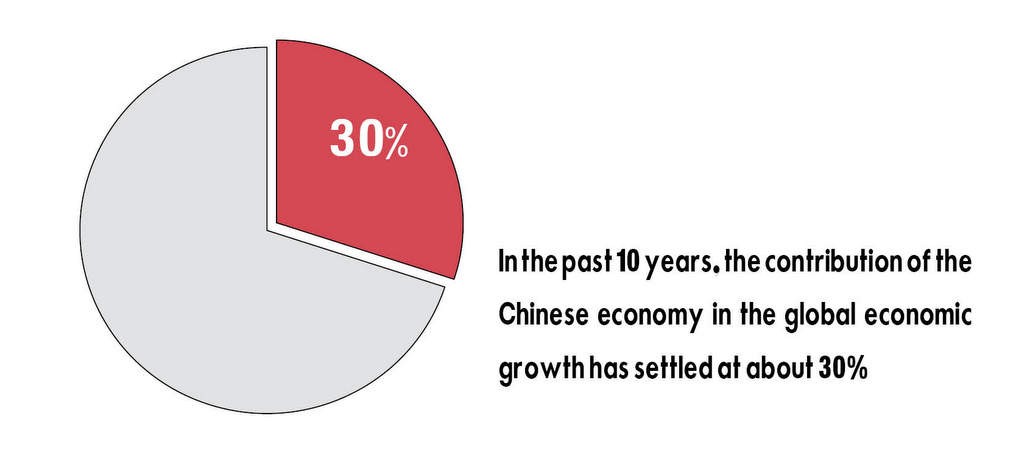

In the past 10 years, the contribution of the Chinses economy in the global economic growth has settled at about 30%. Even through the last couple of years which were marked by the decline of global growth in conjunction with the outbreak of Covid-19, the average rate of economic growth in China has reached 5.1% in two years, to be ranked first amongst the major economies in the world and continue to be the engine of global economic growth.

This has greatly accelerated the process of demonstrating the change in the global weight of the United States, and has put an end to the visions that viewed Washington as the engine of global economy during the post-World War II decades. On this very ground, the necessity to accelerate the changes in the international political structure in a way commensurate with the changes in weights and economic roles is rising today, and in the heart of this process is a necessity to end the dollar’s hegemony on global economy.

Sanctions: A Weapon Aimed at the Dollar Itself

Second: The United States have continued to decrease the confidence in the U.S. dollar excessively. Based on what the so-called “America First” principle, former president Donald Trump fought a trade and customs war using economic sanctions as a weapon that clearly accelerated U.S. regression and pushed U.S. global leadership further down. After current president Joe Biden came to power, he did not actually make any procedures to raise the international confidence in the U.S. dollar. Moreover, the Fed’s unlimited quantitative easing policy after the Covid19 pandemic has pushed to further lost confidence in the prospects of the recovery of the U.S. dollar.

After the war in Ukraine, the United States and Europe have agreed to exclude Russia from the Society for Worldwide Interbank Financial Telecommunications (SWIFT), which raised concerns among various countries that rushed to study the settlements of global exchanges and alternative payment systems away from the U.S. dollar. As such, we see more countries looking for more stable currencies. That did not only apply to the Astana Process countries, as Turkey has started to reduce its holdings of dollar assets, Iran has announced that the pre-assessments of its oil transactions will not use the U.S. dollar anymore, and Russia has started to use its local currency in its natural resources trade, but also major European countries themselves are now promoting the European version of the payment system.

Localization of Production and Breaking Unequal Exchange

Third: There is a new development in the International Division of Labour: after the outbreak of the financial crisis in 2008, the process of the globalization of global economy under the control of the U.S. has slowed down, and the direction of the localization of production has strengthened in a large number of countries that are against the hegemony of the United States. As we mentioned previously, this increases the global weight of the most powerful countries regarding raw materials and real production. The groundwork was actually laid to end the unequal exchange system which for decades allowed Western countries to plunder raw materials from Asia, Africa, and Latin America at less than their real values, and then export them as manufactured products at prices a lot more than their real value (we can all see today how some countries have already begun to price their wealth with a currency other than the U.S. dollar).

Back to “Bretton Woods” and a Look Ahead

No doubt that the process of building the new global monetary system will take its time, and there will be pauses and a reformulation of plans every now and then, however, the important thing is that the process itself is accelerating sharply. In August 1971, we moved from the gold standard to the “credit situation”, as the United States unilaterally abandoned linking the U.S. dollar with gold, because it could not keep its promise that an ounce of gold is worth $35, disrupting the Bretton Woods system. Since the end of the last century, doubts about the situation of the U.S. dollar were increasing, with the euro emerging as a strong competitor in 1999, but it has not been able to eliminate the hegemony of the U.S. dollar due to the U.S. power at the time. Today, we are at the heart of a phase where the ability to impose international exchange currencies other than the dollar is enhanced.

This is why settlements using local currencies between the countries of the world is increasing, and more regional settlement arrangements were formed. Taking the Belt and Road initiative as an example: the countries along the road are working to create a more complete financial services system, such as accelerating network planning of local state financial institutions in countries along the road and building a non-dollar exchange, payment, and settlement system alternative to SWIFT.

In addition to core operations such as international settlements and transfers, companies participating in the Belt and Road Initiative will also be provided with new operations such as local credit loans and interbank lending. When the time comes, it will be possible to expand relevant services to include smaller start-ups as well as investment banks, futures contracts agencies, etc. In other words, the direction of breaking the U.S. financial hegemony is moving at an accelerated pace and will include not only large, but also smaller operations.