- Articles

- Posted

Three-quarters of Government Subsidies Have Been Drawn in Ten Years.

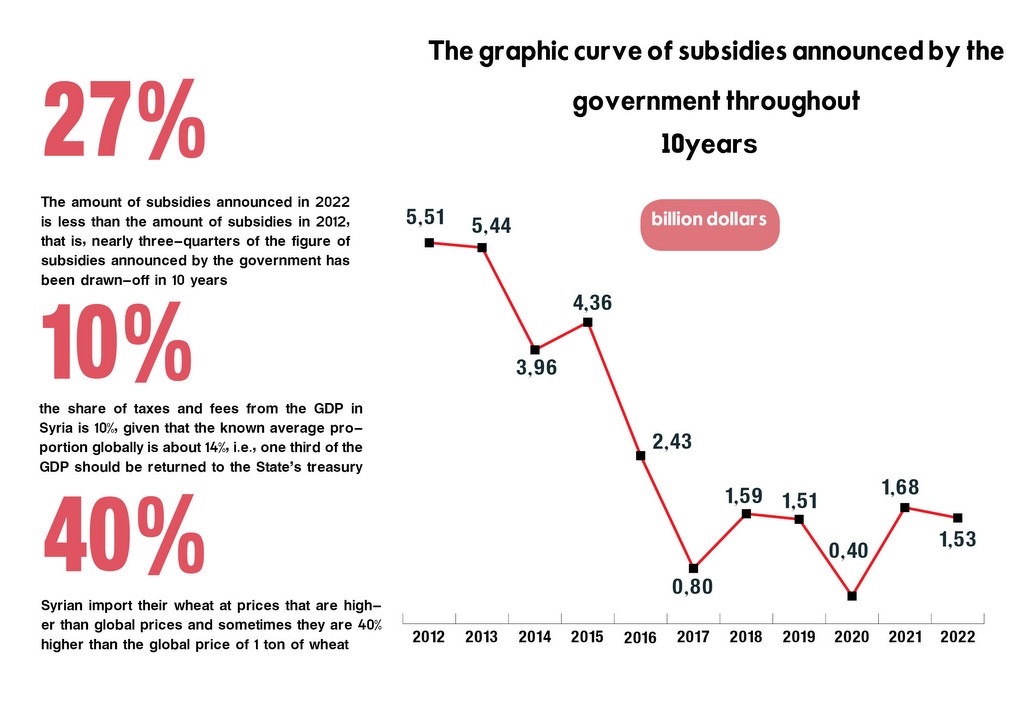

Despite the series of public objections and rejections that came in response to the Syrian government Resolution of lifting subsidies away from strata of the Syria people, some of its officials insisted on trying to “justify” the Resolution in several ways. The last of which was making Syrians feel “indebted” for the amount of subsidies announced in the State’s general budget of 2022, which amounts to approximately 6 trillion Syrian pounds, in a way that suggests two things: The first is that this announced figure will actually be spent on subsidies. The second is that government subsidies have increased given the announced jumps in the figures of subsidies of this year compared to the past year, as the figure of subsidies for 2022 is 63% higher than in 2021, when the government allocated 3.5 trillion Syrian pounds for social subsidies.

Officials in the government have repeated again for people the justifying reasons of the ongoing process of lifting subsidies, considering that the aim of this process is not “lifting subsidies” for one class and maintaining it for another, but “the aim is purely economic, social, and national and will positively reflect on society despite the difficulties it carries”. It is not necessary, of course, to recall here that the government revealed this “positive effect” when it said that the current process of lifting subsidies will save nearly one trillion Syrian pounds, as it will try to “mitigate the budget deficit using part of this amount of money, and it will re-inject part of it to production and to families most in need”.

Which means that even if we decided to think of good intentions of the government and consider that it is sincere in its approach to mitigate budget deficit, it has done so at the expense of the people who do not bear the burden of government policies, which have driven the State to scarcity in revenues, eliminating sectors of real national production, and the collapse in the value of the Syrian pound. So, how would the situation be when everyone is certain – and declares that most overtly – that what is happening is part of a journey towards lifting subsidies that has started to appear in the country since before the outbreak of the crisis in 2011.

Crossing the Red Lines

Among the paradoxes that have sparked a joke during the past week, is the statements that were reported by a local newspaper about the Prime Minister, in which he confirmed the change in the way the government deals with the idea that “bread is a red line”. It is no longer a red line in the concept of the price of a bundle of bread, but rather in the concept of continuing to support agriculture, and providing bakeries with wheat and flour, so this food material remains available at an acceptable price for the citizen who deserves to receive it at this price! Once again, the government recalls the unjust economic sanctions on Syria and that the reservoir of Syrian wheat in the eastern region is occupied by the US.

We will not stop at this point for long, as it received a lot of responses on social media, rather we will just ask these questions: what has the government done – throughout the years of the crisis – to secure wheat at suitable prices? What about the tens of billions of Syrian pounds that are earned annually as profits that go in the pockets of wheat importers in the country? Won’t the profits of these brokers, who accumulated enormous wealth from the unfair commissions they received, be more useful if they became a source to fill the budget deficit? What kind of logic is that Syrians import their wheat at prices higher than global prices (sometimes they are 40% higher than the global price)?

Defending Money Moghuls

In a pre-emptive move against those who want to criticize the government for favoring the earners of huge profits, the government was surprised by the ongoing talk about money moghuls and the amount of money they can provide to the State’s public treasury instead of lifting subsidies for the people, wondering: “Who said that they do not give or pay?”

In an attempt to demonstrate that the government is doing its job regarding taxation, the Prime Minister referred the questioners to what the Central Commission for Inspection and Control and the Central Agency for Financial Monitoring and Administrative Jurisdiction are doing, as they received back evading taxes of hundreds of billions. He also referred to what the Ministry of Finance is carrying out from tax audits and reforms such as the Real Estate sales law.

Here, two points should be recalled: the first one is that claimants of tax reform do not mean that it should only be done with small or medium-income merchants, but also with war profiteers; fat cats who are accumulating huge wealth and keep finding ways to tax evasion, and to several profit positions that are tax free. The second one is that the tax figures in Syria speak for themselves: in all countries around the world, there is an important economic indicator which is the share of tax revenues and fees from the GDP (this indicator is used to determine the share of GDP that is returned to the State’s treasury). According to the estimation of the Organization of Economic Co-operation and Development OCED, the average figure of the share of taxes and fees from GDP is about 34%, i.e., one third of the GDP should be returned to the State’s treasury. So, what is this proportion in Syria? In some budgets, it was less than 10% of the GDP! If so, then what kind of tax collection is being talked about?

Deficits and Traditional Solutions

The government also considered the Resolution of lifting subsidies “an indispensable solution to address the deficit in the State’s general budget, with the inability to pursue other traditional solutions to address this deficit, such as increasing and enhancing general revenues by reconsidering service allowances and increasing taxes and fees”.

First: are these really just where the State’s revenues are increasing? Why doesn’t the government say a word about industry, agriculture, and the overall aspects of real production being an essential key to increase the State’s revenues? And why doesn’t it provide us with facts about its actual role in this regard?

Second: if the government considers that it was not able to reconsider service allowances and increasing taxes and fees during the past period, then what has been going on recently? Has increasing levies and increasing/modifying fees not been the general feature of the government’s performance recently?

Third: why is the budget deficit being treated as a new factor resulting from crisis conditions? Has the Syrian government not used deficit financing since at least 2006? What assures that the government is actually spending what it announces in its budget or not in absence of issuing a closing of budget accounts since 2013? Isn’t the announced huge deficit figure – which could not be verified at all – considered a justification for the government to reduce social subsidies towards removing it completely? Just a look at the figure of social subsidies during the past 10 months is enough to answer this question.

Subsidies of 2022 are Quarter the Subsidies in 2012

As mentioned above, behind the government’s continuous speech about “maintaining subsidies and directing them towards those who deserve it”, there is a continuous reduction and gradual withdrawal of these subsidies. If we are to overlook the fact that subsidies figures announced by the government are questionable and inflated in the first place, we will find that these same figures have been shrinking throughout the years if we compared them to the exchange rate of the Syrian pound in the black market. We will find that the amount of subsidies announced in 2022 is less than 28% of the same amount of subsidies in 2012. That is, nearly three-quarters of the figure of subsidies announced by the government has been drawn-off in 10 years.