- Articles

- Posted

Sanctions and “Bullying” … Wheat as an Example

The impact of international sanctions cannot be separated from the deterioration of all economic and social indicators in Syria, as the blockade is a major contributor to the deterioration of health indicators, such as: decrease in the average age, increase in child mortality rate, expansion of undernourishment, and others. The blockade is also a major contributor to economic deterioration based on all its indicators.

However, more importantly, sanctions can never be separated from the enhancement of other indicators: the amount of looting, corruption, and monopolization; the increase in the role of intermediaries; the increase in convoluted and illegal methods, and the expansion of black-market activity and chaos linked therewith.

Importing to the State’s Benefit and Sanctions’ “Profits”

The impact of sanctions is clearly evident in imports, specifically imports to the Syrian state’s benefit, which is the most restrictive aspect of foreign trade. This is due to the sanctioning foreign parties’ tightening of monitoring of the import operations to the government’s benefit, even though the sanctions say that they exclude food, but it seems the intermediaries do not.

The International Trade Center date provide some details that allow a concrete comparison of the costs of importing materials into Syria, where the import data published by the Center include the costs of shipping and transportation.

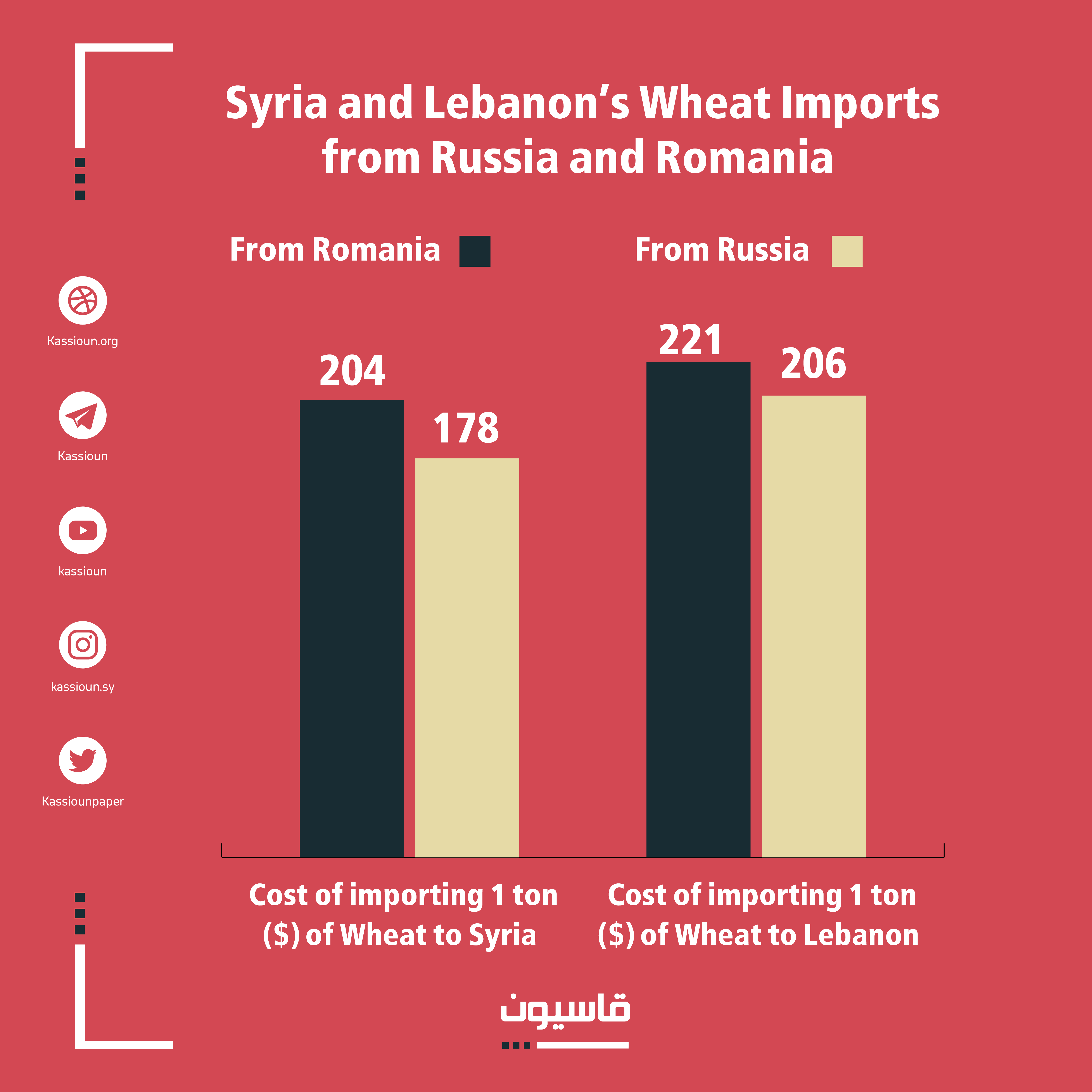

If we take wheat as an example, it becomes evident that based on international data, sanctions do not affect the exporter’s pricing of something, nor do they affect shipping and transportation costs. To clarify further, Syrian and Lebanese imports from the same sources can be compared, where Russia and Romania were selected as they are the two main sources of importing for the two countries (where the distance and cost of shipping and transportation are nearly the same). The figure below shows the details:

Data on Wheat Imports in 2019

The import prices to Syria are lower than Lebanon, whether from Russia or Romania, although the shipping distance is the same, which indicates the purchase of lower classes of wheat compared to Lebanon.

- Syria imported from Romania and Bulgaria 86% of its wheat in 2019, while it imported from Russia less than 15% even though the price from Russia is 13-10% lower (about $26 per ton). While Lebanon imports more than half of its wheat from Russia, which is the cheapest source internationally.

- Syria imported 232 thousand tons of wheat in 2019, which is less than 10% of the consumption needs, while official Syrian statements have indicated the signing of three importing contracts, each of which amounted to 200 thousand tons (of which only about a third came).

- According to official government statements, the signed contracts for wheat import in 2019 included the price of $310 per ton for the first installment of the contract, which is $110-$132 per ton higher than the actual import price, and 53%-74% of the import price. That is, an increase of $56 million for the import of 232 thousand tons.

- If this is “the cost of sanctions”, then it is practically paid from public money to essential import sources, specifically the costs of insuring and financing in the financial sector, whether in the banks of the international source from where imports are gotten, or domestic banks, in addition to the intermediary’s share.

- These additional costs are, so to speak, the costs of “moving the foreign currency in the accounts”. The sanctions practically track the banking movement, and the destination and function of using the money. These costs are not transparent because they are done in agreement between the intermediary and the banks, and they are non-specified costs that can be moved at any percentage agreed upon by both parties.

- Tracking the banking movement is practically done by tracking foreign currency transfers, specifically the dollar and the euro, using the SWIFT system, which includes most of the international financial institutions, and to which most international banks subscribe.

- Sanctions are an opportunity to increase the costs of importing the basics by up to 53%-74% as in the current example of wheat, but who gets these profits? The foreign bank in which the Syrian intermediary deposits his money must be receiving an essential share of this profit, as does the domestic private banking system, which is for the most part affiliated with regional foreign banks, which are in turn affiliated with international banks. The intermediary with the import advantage and with the money gets an important part of these additional costs. Knowing how the domestic economic system works, we know that the influential powers that give the certain intermediary the advantage of obtaining a tender for importing wheat into the country, also get the most important share of this profit. Thus, sanctions distribute profits between the international financial system and the domestic corruption and monopolizations powers, specifically those with influence and bureaucratic advantages.

Yet again, we should say that bypassing sanctions is possible, by having contracts for direct importing between governments at international prices, and in currencies other than the dollar. The international money system will not be able to punish the Russian government, for example, because it supplies wheat to Syria, at the time it supplies arms, aid, etc. Nor the Chinese government for agreeing to a contract with the Syrian government to supply the basics. However, such a procedure is like a “severe blockade” of the domestic system of plundering and corruption that does not want to “lose its livelihood” that it earns through the plundering made possible by the sanctions, and also does not want to sever its connection with the Western money system despite everything that has happened.

Ashtar Mahmood

Ashtar Mahmood