- Articles

- Posted

The Energy Crisis. Less than half of the Minimum Needs. Between Financing and Coping with Sanctions.

Why is it so difficult to provide stable energy flows? Is it the sanctions? Syrian official authorities deny the fact that the sanctions are the main reason of the current economic crisis, rather they point towards adapting to it and to the fact that it existed before. So, according to them, the problem is due to dollar shortage, particularly its shortage in Public Finance, and the inability to pay suppliers.

So far, heating oil allocations have not been distributed for the winter, and public transport is less due to lack of diesel oil. The crisis of gasoline is also not over yet, as subsidized allocations have decreased and the prices have risen, so providing gasoline is still a problem. Most importantly, electricity only gets half of the power needed to secure the basics, according to the statements of the Minister of Electricity. The failure in securing energy flows is a catastrophic and recurrent failure. It is in the root of economic deterioration which drags along deeper humanitarian disasters.

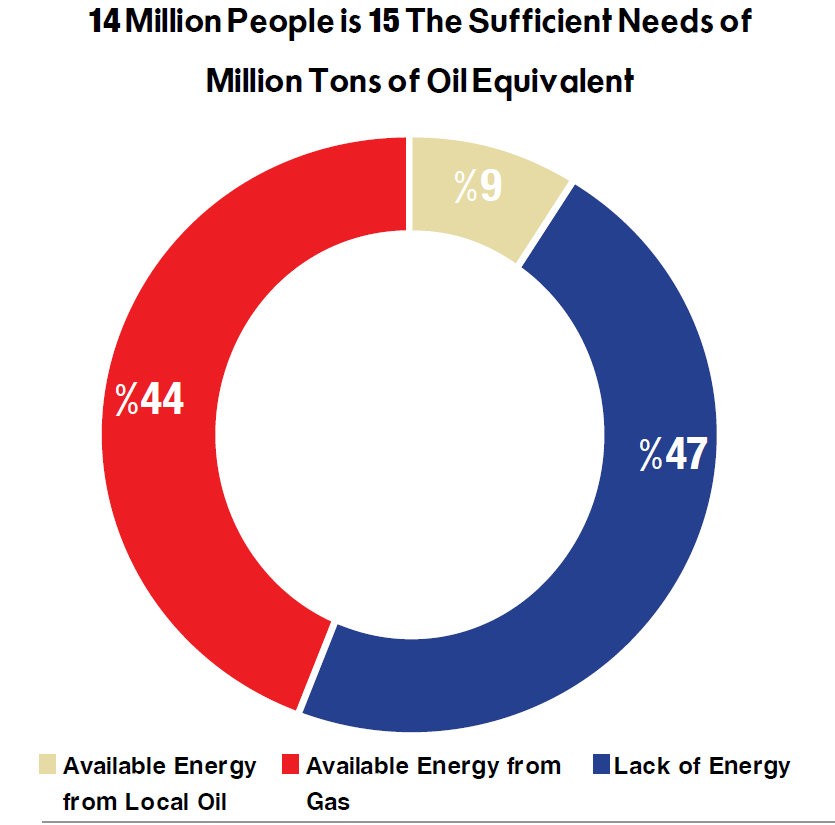

Securing energy flows with a share per capita that approximates the levels of 2010 practically means securing approximately 14 million barrels of oil equivalent, and this is to meet the needs of 15 million people only! This need might increase to 18 million barrels of oil equivalent annually, if we were talking about securing the average energy needs of 19–20 million people and in the case of running all the regions in the country or the return of refugees from Lebanon, Jordan, and Egypt for example. According to the local production of gas and oil on 2018, securing these amounts requires importing approximately half of the energy needed, and approximately 7 million tons of crude oil, in addition to what this requires of money flows and mechanisms to cope with sanctions and secure ships and their transit.

The Need to Import 7 Million Tons of Oil

The necessary import needs for the minimum number of inhabitants currently, and to solve the energy crisis, requires importing 50 million barrels of crude oil annually, and about 140 thousand barrels a day, which is equivalent to 7 million tons of crude oil annually.

Financially, it can be said that the cost of these oil imports could approximate $2.5 billion annually, which are the sums needed to cover those needs (according to the current global crude oil prices with an additional 10% margin: $47 per barrel). Although the actual contracts can be signed with lower prices under the decline in the global demand for oil, this could be difficult in the situation of Syria. The sum of $2.5 billion today is equivalent to two-thirds of the Syrian budget according to the dollar of the market, and the most important thing is that it is wanted in foreign exchange.

The scarcity of public financial resources, particularly from foreign exchange, is the biggest problem in securing energy. Practically, the flow of foreign exchange to the public treasury is only available through mechanisms such as: some exports that have decreased to a large extent and that only a small portion of their foreign exchange returns to the public treasury, in addition to the types of fees and services of embassies abroad and other minor aspects. Whereas, the main resource for the flow of foreign exchange in the form of remittances in the current situations of Syria is transferred to the black market.

The last official estimates for remittances date back to 2018, which approximated back then $3 billion as a bloc of annual remittances arriving to official authorities when the exchange rate of the Central Bank and the market were close (480 Syrian pounds in the Central bank versus less than 500 Syrian pounds in the market). Those remittances can flow again if the illusionary exchange rate of 1250 Syrian pounds was corrected, which is not used today in any cost estimate, rather the government prices the costs of its imports and charges importers with a price above 2200 Syrian pounds. However, the price of 1250 Syrian pounds for remittances is no good for anything, except in the continuation of the flow of remittances to the black market.

This, of course, is one of the most clear and practical sides of resources, which is left to the market clearly, while many other sides of resources are abandoned, like the issues of corruption that have been publicized last year and the statements of property freezing that did not reach any results nor did it increase the state’s ability to secure any part of the basics. On the contrary, the policies of reducing public payments went far beyond the basics and the increase in obtaining bread, fuel, and other things.

On the Transportation Level

The current method of supply of oil and derivatives could never solve the crisis, nor can it increase energy flow. First: because those suppliers import small amounts at high prices and high costs that exceed the global price by 40%. Second: because with their conglomerate companies and their import which includes trade of oil and international derivatives, they become subject to sanctions and they only provide small, intermittent and unstable amounts.

The other way of securing flows through Iran is questionable, as Iran used to adopt a payment mechanism that avoids sanctions through the Iranian credit line to Syria, and until 2018 it was able to secure frequent periodic flows through small ships. (For example, Suez Canal Authority indicates that in 2018 Iranian tankers carried 1,5 million tons of oil to Syria in 55 ships that crossed the canal, i.e. the average shipload is 27 thousand tons of oil, which is the need of less than two days).

Sanctions on Iran are not the main reason for stopping these flows, because Iran offered to provide oil to Lebanon in local currencies, during Lebanon’s recent crisis. The problem may be complex, as the oil flow from Iran that almost stopped at the end of 2018 and the beginning of 2019 coincided with the start of escalating sanctions on Syria and Iran, particularly in the area of oil transportation. This was demonstrated in the confiscation of an Iranian ship in Suez Canal, although the Egyptian side denied that the suspension was because of the sanctions on Iran and Syria (as the canal’s byelaws prohibit the confiscation of ships unless there was a decision from the United Nations or there were contraventions on ships). However, international political factors can create reasons for contravening Iranian ships and this might be what contributed to obstructing the flow of Iranian oil. However, can all ship flows be prohibited on the pretext of contraventions?

It is likely that the flows of Iranian oil slowed with a host of other complications, including the costs resultant from not paying the full amount of Iranian oil credit by the Syrian side despite selling it in the local market.

Coming Out to the Public and Confrontation

Reducing the risk in facing the sanctions and securing energy flows requires openness and linking up with official authorities, in contrast to the adopted mentality of dealing with the sanctions. This requires the Syrian government to have its own transport vessels, in addition to decades of stability with regional or international parties with fixed prices and interface payment mechanisms. In the time when there are international parties willing to contribute militarily, politically and economically in the Syrian crisis, and while they have opened a margin to cope with the sanctions, then the deficiency until today lies in the Syrian management for not solving crises in a radical way – a way that is based on the role of the state apparatus so that it owns its transport vessels, its financial resources, and a bold decision in mobilizing resources to secure the basics, and finally owning the decision in dealing with currencies other than the dollar to cope with the sanctions. However, until today the Syrian decision is still limited by depending on intermediaries who provide small amounts of energy intermittently and with skyrocketing prices.

The energy crisis is the mainstay in rescuing the economic Syrian situation and allowing life to continue. The current energy import method and the huge scarcity will only lead to great economic, social and political crises. Because energy is the mainstay of production and an essential element in the requirements of living, so greater humanitarian crises can only be solved by solving this kind of crisis. Energy today is insufficient for 15 million Syrians in government-administrated areas, and the crises of infrastructure rehabilitation and the return of refugees cannot be solved with half of the needed energy!

7 Million Tons:

Securing the basic needs of energy at the same level that was in 2010 for about 15 million Syrians only requires importing 7 million tons of oil annually and about one thousand barrels annually.

2.5 Billion Dollars

Importing 50 million barrels of crude oil to meet the basic needs today amounts to 2.5 billion dollars according to the local price of the barrel and an additional 10% margin.

Ishtar Mahmoud

Ishtar Mahmoud